Blogs

Bump-upwards Dvds along with allow for certain risk because they often have all the way down APYs than just particular fixed-rate Dvds however, allow you to request a top rates at the minimum once inside Computer game’s label should your financial raises costs for new customers. As well, you could believe a brokered Cd that is included with a higher chance and higher APYs. The word amount of the newest Computer game is vital — it decides how long the cash might possibly be locked within the, with lengthened words typically providing high prices. Based on debt wants, the phrase amount of a Cd is an important grounds in order to consider while the APYs vary based on the duration of the word. Along with, you generally spend a penalty so you can withdraw your finances through to the label is up, therefore consider if you can keep your finances locked up to own the length of the word you decide on. In our newest MarketWatch Books team Video game questionnaire, more 78% men and women selected its name according to interest rate, if you are twenty eight% based the choice to the after they’d you want their money.

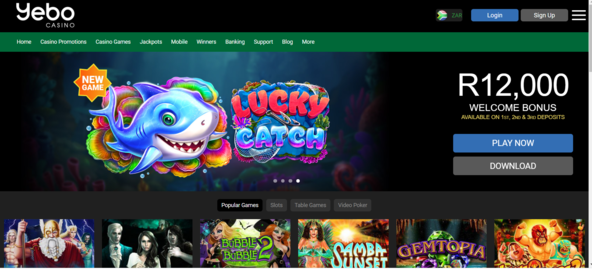

If you would like a bank account, the brand new Friend Bank Using Account got you secure. It has no monthly fees, no overdraft fees, and entry to early direct put to help keep your earnings running well. The newest Ally Bank account offers a substantial step casino Vera John Dk review 3.60% APY and no minimum harmony. You to definitely talked about element ‘s the “buckets” unit, and that enables you to split the deals to the other requirements (including for issues otherwise an alternative automobile). The most famous option for informal play with is the BMO Smart Virtue Bank account. It’s got zero monthly charges if you undertake elizabeth-statements without minimum balance criteria.

Just what Writers State Regarding the Discover Bank

But not, specific banking institutions render no-punishment Dvds — known as drinking water Cds — which permit you to withdraw the money early without having to be recharged a punishment. For those who withdraw away from an excellent Cd before it develops, the fresh punishment can be equal to the level of attention gained while in the a particular time frame. For instance, a bank will get impose a penalty away from 3 months out of easy desire on the a-one-seasons Cd for many who withdraw away from one to Computer game before the year is right up. Yearly commission output (APYs) and you may minimal deposits are some of the points that compensate Bankrate’s rating. Much of which improve is due to the brand new Government Put aside’s rates nature hikes throughout the 2022 and you can 2023. While you are rate incisions was around the corner afterwards this current year, banking companies continue to be giving raised Video game prices—especially for smaller words.

Price info is acquired because of the Curinos, a merchant from merchandising banking search one gathers deposit prices study from over 3,600 loan providers. These products could have stricter requirements than our selections a lot more than – comprehend the establishment’s webpages for more information. If you are on line discounts account offer a number of the higher APYs, additionally it is a lot more tedious to view your finances than banking during the a brick-and-mortar institution, while the you’ll be able to usually have to help you move into a checking account to make use of money.

Residential district Lender & Faith Company

They’ve been given by a handful of borrowing unions you to may have registration constraints. Yet not, while the Computer game cost is increase and slide considering economic climates, Dvds using 6.00% APY can be more common if interest levels boost. It was quick and easy to prepare an account having Barclays, requiring only eight presses to accomplish the procedure. Rates for everyone Barclays on line Dvds is actually competitive, there are not any minimal starting put standards. Barclays in addition to will give you a little more than other banking institutions to help you fund the Video game — around 14 days. Places is generally insured to $3M as a result of participation from the system.

Across the country plus Chicago, Computer game costs is actually broadening, specifically those that are offered from the on the web banking institutions. Away from this type of, 40 banking companies produced our number, picked centered on its competitive interest rates, the many identity options available, the flexibleness of the conditions and terms, and you can overall client satisfaction and economic stability. To own buyers, this type of economic indicators highlight the necessity of provided regional economic conditions when designing financial behavior. Cd prices in the Chicago, dependent on both national and you may local monetary issues.

Whether you earn the fundamental Digital Bag or modify they, you can buy advantages including highest desire earning possible (to your Development account), Automatic teller machine commission reimbursements, and much more. Consider the bank’s has, charge, advantages, and you may cons when making the decision. (ii) provide to the fresh tenant a created effect which kits forth a keen factor out of how the attention paid is computed. The banking companies noted on BestCashCow is actually FDIC insured; BestCashCow.com firmly recommends you stand inside FDIC insurance coverage constraints and you will that in the event that you try being unsure of out of the way the limitations connect with you, please go to the fresh FDIC webpages.

Do i need to purchase Dvds?

Checking account are best for people that should continue their currency safer if you are still with effortless, day-to-go out access to their money. For individuals who’lso are going to use these money in this a-year, a good six- or 12-month Video game are a safer bet. Such possibilities give reassurance for those who don’t you would like use of the fund any time in the future. The best Computer game prices have a tendency to confidence just how long your’re ready to protected your finances. Lower than, we’ve divided the major options from the identity size to simply help the thing is that the right complement the savings wants.

Also, the new tenant’s capacity to recover its protection deposit to own a breach from package is restricted. Whenever an event breaches an agreement, additional group can be query the brand new court becoming considering what they missing because of the violation. In the example of protection dumps, it means the newest landlord will be get back the brand new occupant’s put in accordance with the terms of the brand new lease. Clients must reveal that they don’t break the newest rent—otherwise, once they performed, that the property owner leftover too much of their put. If your occupant is successful, the fresh judge often award the amount of money the newest landlord is always to features returned. Since the apartments never provide for a penalty, clients must glance at the difficulties of litigation to get the count the brand new landlord have to have given her or him to start with.

Basically, Cd rates is fixed and not flexible—specifically in the on the web financial institutions and federal institutions. But not, particular smaller banks otherwise regional borrowing unions can be willing to render somewhat best rates if you’re also transferring much or features an existing reference to him or her. A certificate away from put (CD) are a fixed-label savings account that gives a guaranteed go back in exchange for maintaining your currency locked in for a set months. The main benefit to presenting regional banks and you may borrowing from the bank unions to choose out of would be the fact such creditors usually have offers or special rates to the Dvds. Dvds, often also referred to as time dumps, is actually a discount automobile the same as a discount otherwise currency industry account, but guaranteeing a fixed speed in exchange for a consumer’s dedication to secure the money deposited up to a selected date (the newest readiness go out). Just inside rare cases, along with the percentage from a penalty, is also the money getting withdrawn very early, and then it is at the lender’s discernment.